Accrued Wages Journal Entry

The intricacies of accounting can be complex, especially when dealing with concepts like accrued wages. To accurately record and manage accrued wages, businesses must understand the underlying principles and apply them correctly in their financial records. This involves creating a journal entry that reflects the accrued wages as a liability and the corresponding expense.

Understanding Accrued Wages

Accrued wages, or accrued payroll, refer to the amount of money that employees have earned but have not yet received. This can include regular wages, salaries, commissions, bonuses, and any benefits that are considered part of the compensation package. The concept of accruing wages is based on the matching principle of accounting, which dictates that expenses should be recognized in the same period as the revenues they help to generate.

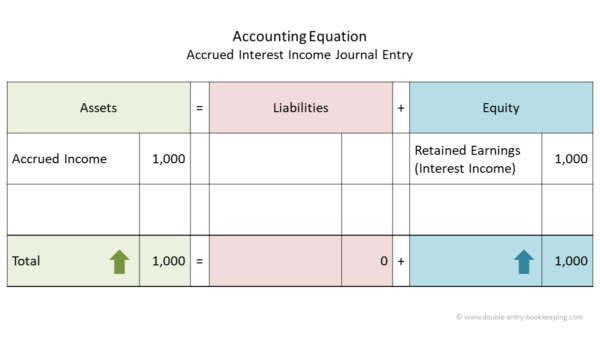

The Journal Entry for Accrued Wages

To record accrued wages, a journal entry is made at the end of each accounting period. This entry involves debiting the Wage Expense account and crediting the Accrued Wages Payable account.

<div class="step-by-step">

<h3>Step 1: Identify the Amount of Accrued Wages</h3>

<p>Determine the total amount of wages that have been earned by employees but not yet paid.</p>

<h3>Step 2: Prepare the Journal Entry</h3>

<p>Debit the Wage Expense account for the amount of accrued wages, as it represents the expense for the period.</p>

<p>Credit the Accrued Wages Payable account for the same amount, as it represents the liability owed to employees.</p>

</div>

Example of a Journal Entry

Suppose a company has $10,000 in wages that have been earned by employees as of December 31 but will not be paid until January of the following year. The journal entry to record these accrued wages would be:

Debit: Wage Expense | $10,000

Credit: Accrued Wages Payable | $10,000

Reversing Entries

At the beginning of the next accounting period, typically in January when the wages are paid, a reversing entry can be made to eliminate the accrued wage expense from the previous period, assuming the payment was made as anticipated. This involves debiting the Accrued Wages Payable account and crediting the Cash account for the payment, along with a credit to the Wage Expense account if the original accrual was for a expense that will not repeat in the new period.

<div class="expert-insight">

<p>It's crucial to maintain accurate records of accrued wages, as these affect both the balance sheet and the income statement. Accrued wages increase the current liabilities on the balance sheet and the wage expense on the income statement.</p>

</div>

Why Accrued Wages Matter

Accrued wages are essential for matching expenses with revenues in the correct accounting period. They ensure that financial statements accurately reflect the financial position and performance of the business. Additionally, correctly accounting for accrued wages helps in budgeting and forecasting future periods, as it provides a clearer picture of the company’s obligations and expenses.

Common Challenges

One of the common challenges businesses face with accrued wages is ensuring the accurate calculation of the accrual amount. This requires a thorough understanding of employee contracts, wage rates, and working hours. Additionally, managing accrued wages in a multi-state or international operation can be complex due to varying labor laws and regulations.

<div class="faq-section">

<div class="faq-container">

<div class="faq-item">

<div class="faq-question">

<h3>Why is it important to accrue wages?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Accruing wages is important because it ensures that expenses are matched with the revenues they help generate in the same accounting period, providing a more accurate picture of the company's financial performance.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do accrued wages affect financial statements?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Accrued wages increase the current liabilities on the balance sheet and the wage expense on the income statement, reflecting the company's obligation to pay wages and the incurred expense for the period.</p>

</div>

</div>

</div>

</div>

In conclusion, accurately accounting for accrued wages is a critical aspect of financial management. By understanding the principles behind accrued wages and correctly implementing the journal entry, businesses can ensure their financial records are accurate, compliant, and reflective of their true financial position and performance. This not only aids in internal decision-making but also provides stakeholders with a clear and transparent view of the company’s operational efficiency and financial health.